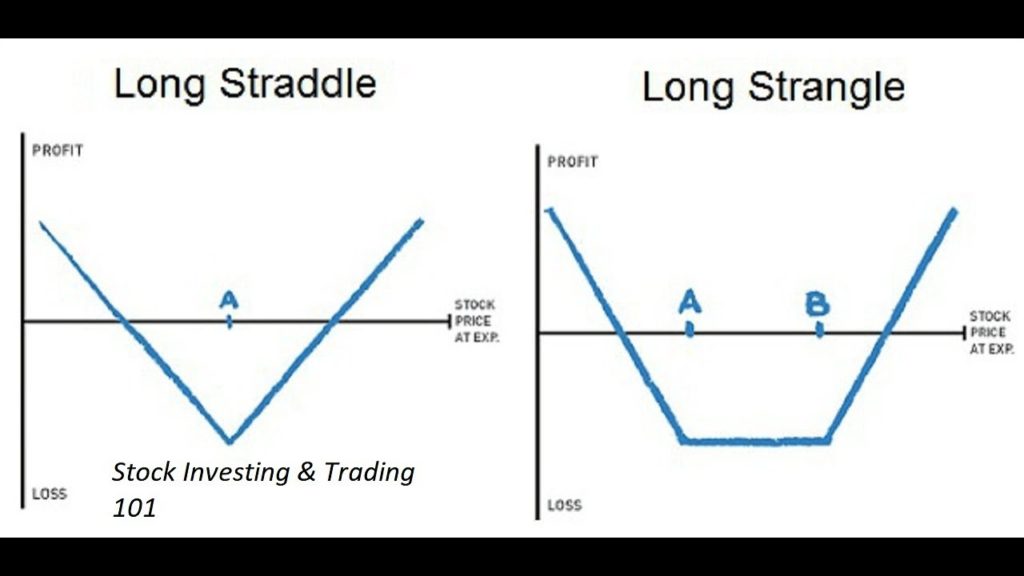

A straddle is indeed an impartial options strategy that involves concurrently purchasing both options call and put for such an important asset having much the same market price and same expiry date. There are two distinct straddle strategies to choose from. A long straddle attempts to make a profit when it is anticipated that stock prices will either rise or fall by a significant amount, whereas a short straddle generates a return when it is anticipated that stock prices will either remain stable or move within a relatively narrow range close to the strike price.

Long Straddle

When you believe that the value of the commodity investment will either drastically increase or decrease within a predetermined amount of time, you might employ a method known as a long straddle. Purchase of a call option and concurrent purchase of a put option on a very similar underlying asset having the same expiration date as well as market price results in the creation of a covered call. This technique is designed to incur a net negative (or net cost), but it can generate gains if the underlying commodity finishes the trading day with a price that is higher than the upper break-even point or lower than the lower break-even point.

Comprehending the Concept of a Long Straddle

A bet known as a long straddle is placed on the premise that the price of the underlying asset would demonstrate considerable fluctuation, either increasing or decreasing. No matter what course it takes, the profit profile that it has always had will not change. The investor has the conviction that the asset in concern will experience a transition from a state of low volatility to a condition of heightened volatility as a result of the possibility of the release of significant new information.

When might one make use of a Long straddle?

Before an important news announcement like any new bill, political action, the enacting of a new amendment, or the outcome of any voting, traders frequently employ a tactic known as long straddle options trading. Since it is presumed that the movements of the market are related to the occurrence of any event like this, it is expected that trading will be unpredictable and will take place within narrow ranges. During the event, all of the reckless bearishness that has been held in check is unleashed, which causes your stored asset to move very quickly. But because the impact is unknown, there is no way of knowing whether to anticipate a positive or negative consequence because there is no way of knowing what the effect will be. The long straddle is the ideal technique to employ in such a scenario since it allows one to profit regardless of the outcome. However, it goes without saying that a long straddle, like any other type of investing strategy, is not without its restrictions and difficulties.

Benefit

When the price of the underlying asset moves either above or below the break-even points, it is to the advantage of the long straddle option. In the event that prices move significantly beyond this range, there is the potential for huge profits to be made. A profit might be made from the strategy if an improvement in the implied volatility of something like the options occurs that is greater than the time value degradation that occurs.

Conclusion

Market participants may now seek benefit from these different forms of trading as the prominence of trading options in the crypto derivatives area continues to rise. One can definitely use the long straddle strategy to trade options.